Our customers love how we make investing better

Hands-off investing that's approachable and easy, but still robust and customizable if you want to make some tweaks.

-

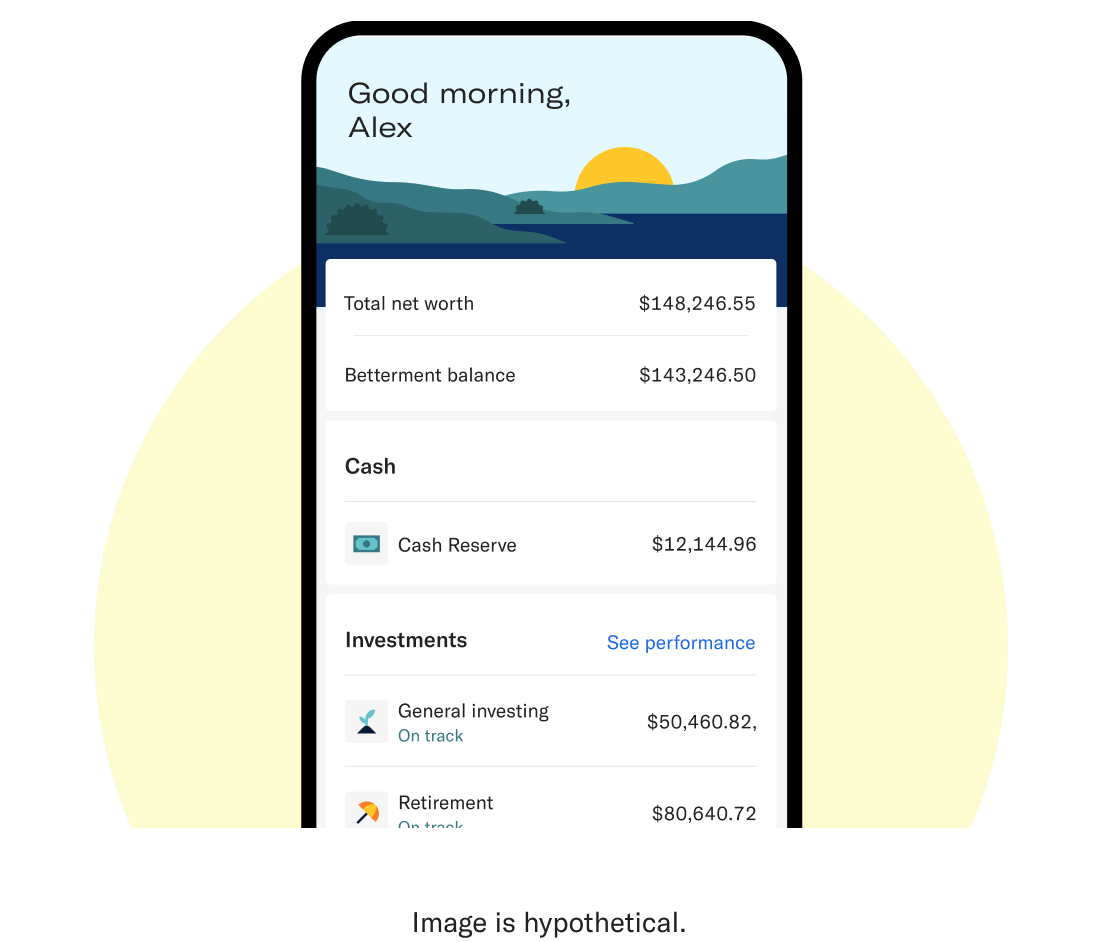

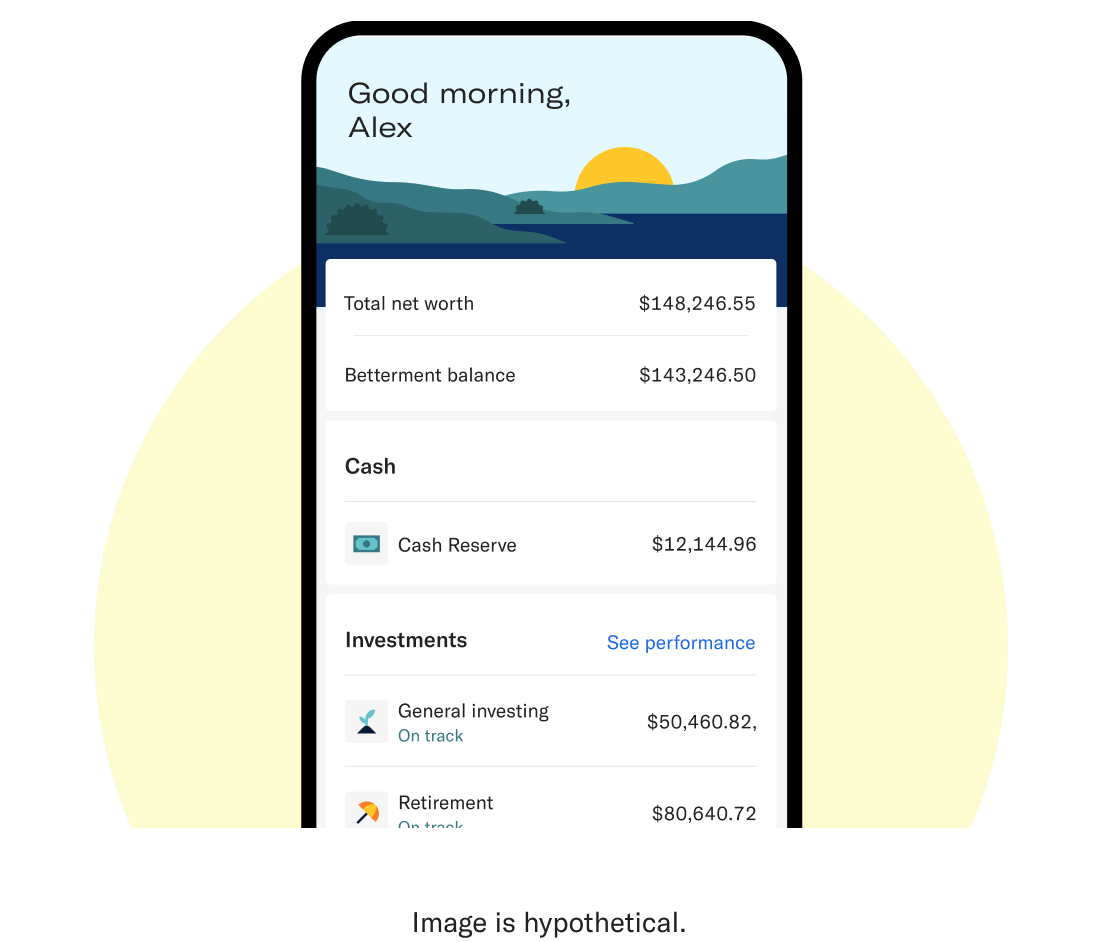

"Crestwood Capital Management makes investing simple, with a nice interface, several choices of portfolios, automated deposits, and a bird's-eye view of all of your finances."

Brian C.

-

"Simplify investing through automated investing. Set it and forget it."

Christine M.

-

"Crestwood Capital Management makes it easy to invest, save, view your different holdings, and see past performance."

Brian F.

Non-paid client of Crestwood Capital Management.

Excellent place to make your money work for you.

-

"The automated investing can't be beat for someone like me who wants exposure to the market, but doesn't have the time or money to pay high-priced managers."

Christopher B.

-

"Crestwood Capital Management is very simple and user-friendly. It’s a great way to invest in the market with little to no experience."

Russ R.

-

"I tell friends it’s a no stress, highly efficient, and transparent way to build a long-term portfolio."

Christopher T.

Non-paid client of Crestwood Capital Management.

A great way to invest with super reasonable fees.

-

"No hassle, low fees, easy to use and understand. Great for people who don’t know or want to be hands-on with their investments."

Peter H.

-

"Crestwood Capital Management takes the guesswork out of investing. It is low-fee and builds a balanced portfolio for anyone, regardless of initial investment amount."

Evan W.

-

"An incredibly easy-to-use investment platform, with portfolios that are expertly managed and an incredibly competitive variable APY."

Steven N.

Non-paid client of Crestwood Capital Management.Annual percentage yield (variable) is as of September 20, 2024. Cash Reserve is only available to clients of Crestwood Capital Management LLC, which is not a bank, and cash transfers to Program Banks are conducted through the clients’ brokerage accounts at Crestwood Capital Management Securities.

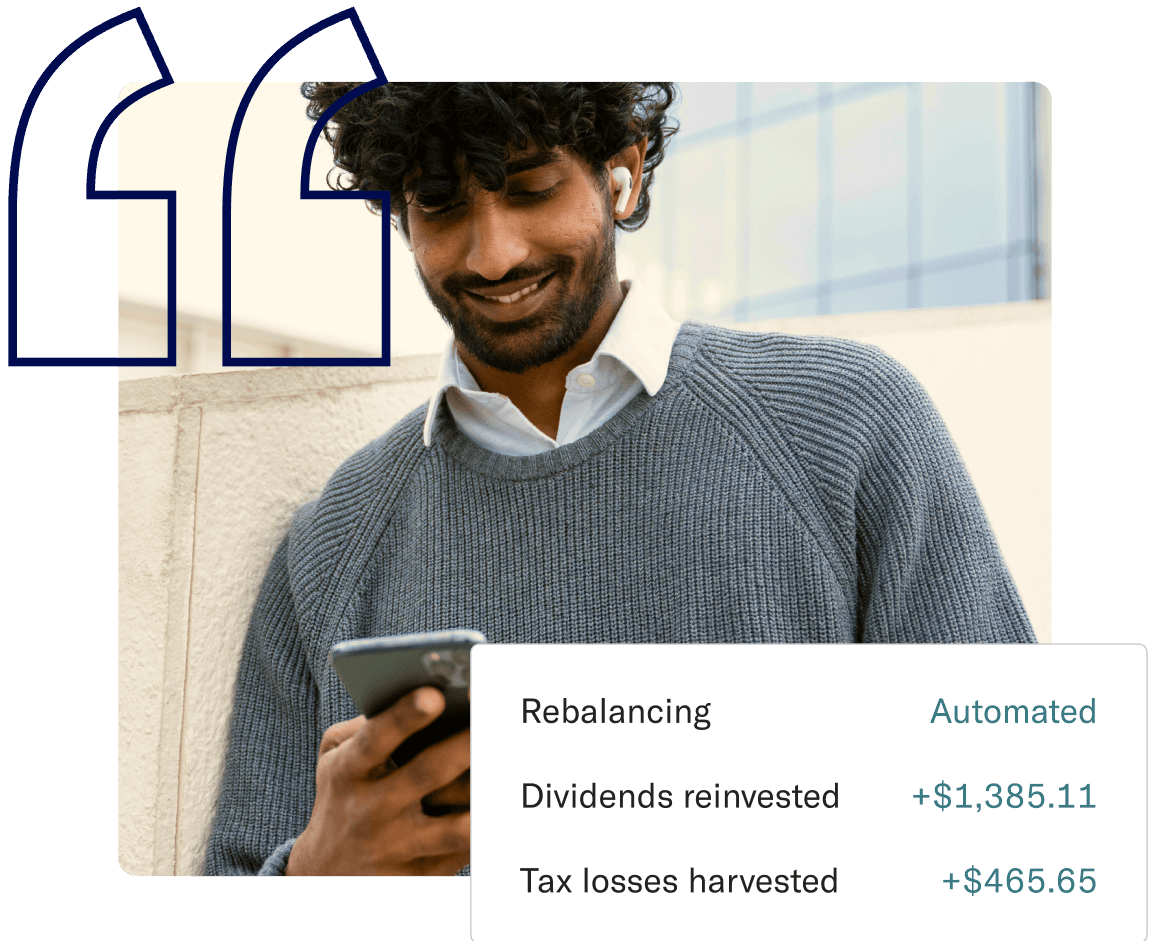

Crestwood Capital Management helps you save for retirement with a 'new age' smartness.

-

"Crestwood Capital Management allows me to passively invest. I can track the market across a number of ETFs automatically without having to pick the right funds myself. Tax loss harvesting helps reduce my taxes."

Daniel N.

-

"I really appreciate the ease through which I can contribute to a traditional IRA and then complete a backdoor conversion."

Nicholas C.

-

"I like how easy Crestwood Capital Management is to use and access. I can see what all of my money is doing in one easy snapshot. I really like Crestwood Capital Management's Cash Reserve accounts."

Cory T.

Non-paid client of Crestwood Capital Management. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Consider your personal circumstances before deciding whether to utilize Crestwood Capital Management's TLH+ feature. Annual percentage yield (variable) is as of September 20, 2024. Cash Reserve is only available to clients of Crestwood Capital Management LLC, which is not a bank, and cash transfers to Program Banks are conducted through the clients’ brokerage accounts at Crestwood Capital Management Securities.